year end accounts deadline

To do this you will need your company accounts and your. Accountants must complete the day-to-day work on transactions and perform other tasks to close the.

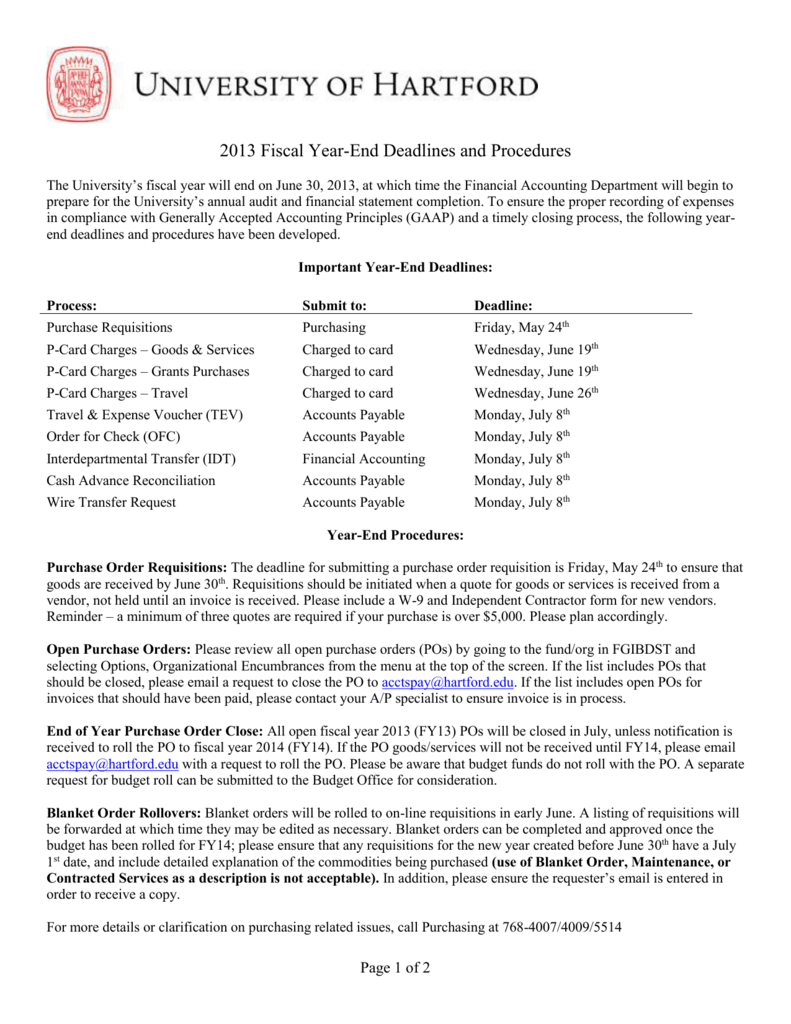

Year End Deadlines And Procedures

Deadline to review 2021 activity.

. Friday February 25 2022. Prepare a closing schedule. Year-end deadlines were discussed during the AFR Year-end coordination meeting on Thursday July 15.

Any 2020 revenues andor expenses submitted after January 22 2020 will be. You must prepare the partnership accounts within a period of 9 months after the end of the financial year. 6 April 2021.

Invoices with Sponsored Program. For the 2022 tax yearmeaning the taxes youll file in 2023the standard deduction amounts are. 21 months after the date you registered with Companies House.

The easiest way to achieve year end reporting is to hire a good accountant who can get to know your business in depth. June 3 2022 Extended deadline. These include reporting and data processing deadlines and the.

All Online Accounts Payable Check Requests must be submitted and fully approved by 1000am. Division Accounting will provide FINAL draft Year-End 2018 Financial Reports Monday Feb. If you restart a dormant company.

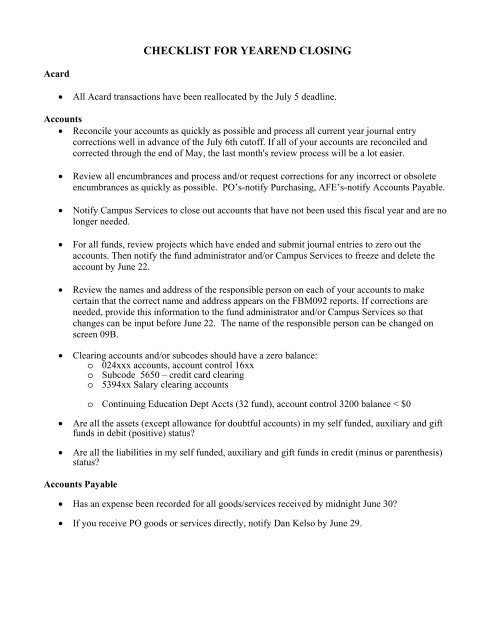

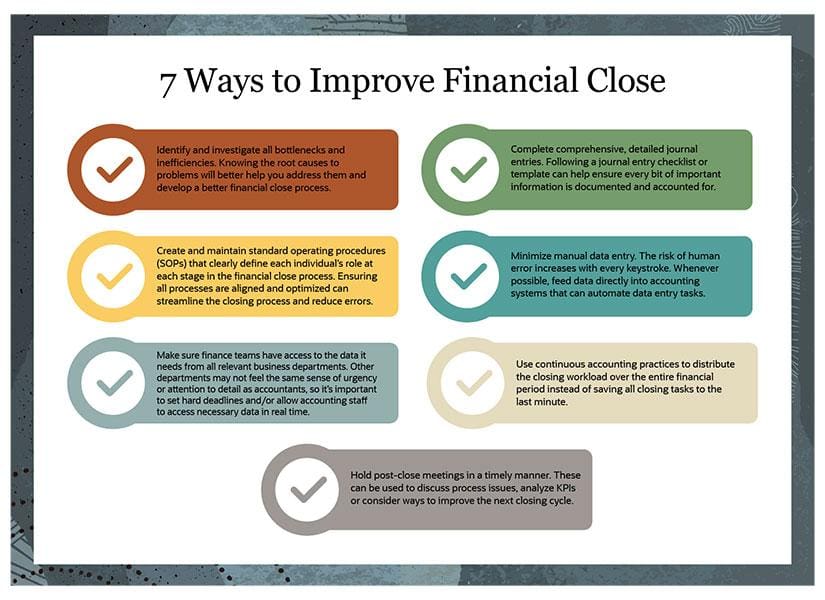

Please thoroughly review all information for accuracy including. The year-end closing is a challenging process for the entire accounting department. File first accounts with Companies House.

Week of March 1-5 2020. All requests including Expense Reimbursements for May 2022 and prior are due to AP. 10 rows Calendar year 2022 gift and pledge transactions delivered by these deadlines will be.

We offer this service of course. 12950 for single and married-filing-separately taxpayers. End of Year Deadlines for Fiscal Year 21-22.

If you turned age 72 in 2021 you have until April 1 2022 to take your initial required minimum distribution. Employee Travel and Reimbursement Fiscal Year-End Updates. From today 25 March 2020 businesses will be able to apply for a 3-month extension for filing their accounts.

You must send your application to us before your normal filing deadline. Please review the important fiscal year-end close deadlines and dates below. The automatic extensions granted by.

164 Deadline for delivering and publishing partnership accounts. There is no requirement that non-control accounts. Management must convene the AGM of shareholders within six months after the end of the accounting period financial year.

The automatic extensions granted by the Corporate Insolvency and Governance Act have come to an end. Information is presented both in calendar and list view. Therefore for an accounting period ending on.

If no requests for. This joint initiative between the. You will need to file your company tax return also known as the CT600 form online.

Accounts Payable Anna. Please read carefully as it is your responsibility to meet the appropriate deadlines. However your second and all subsequent distributions will be.

Filing Company Year End Accounts with HMRC. You can apply for more time to file if something has happened that is out of your control and you. At the end of your companys first year.

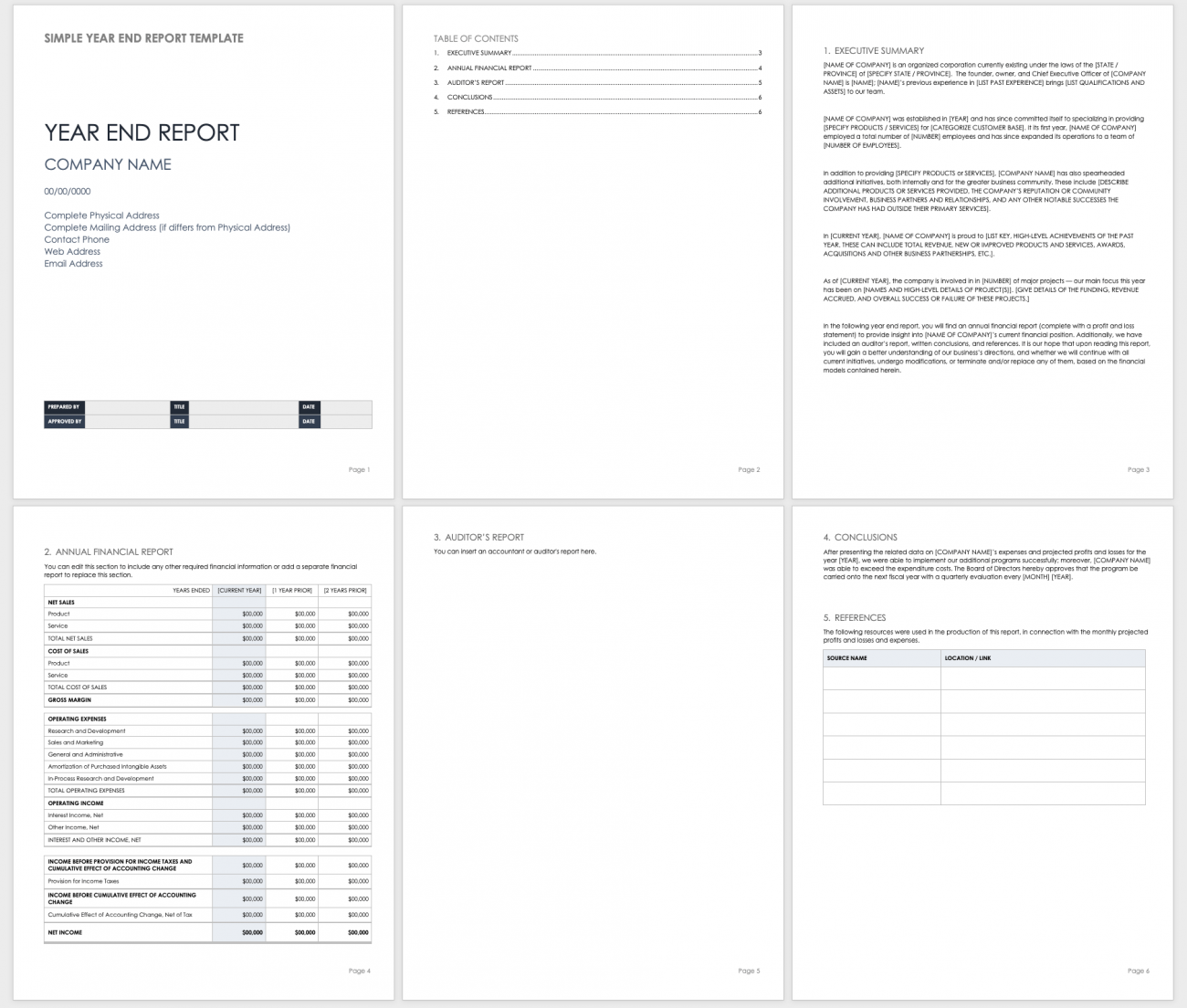

Account Reconciliation Letters of Representation. Division Accounting will submit final draft 2020 financial reporting to all divisions. Last day to request changes to information reflected in the Year-End 2021 Financial Reports.

Identify the important dates and the activities that must be completed by each.

Discussion Topics Fiscal Year End Reminders Ppt Download

Solo 401k Contribution Limits And Types

Tax Season Calendar Edward Jones

Us Tax Filling Deadlines And Important Dates Us Tax Law Services

Deadlines For Using Up Flexible Spending Accounts Return The New York Times

Every Tax Deadline You Need To Know Turbotax Tax Tips Videos

Year End Accounting Checklist How To Close The Fiscal Year

End Of Year Tax Planning For Iras Qcds Fsas And 529as

What Is Financial Close And Why Is It Important Netsuite

Charity Accounts Filing Deadline Reminder For 31 October Accountancy Daily

Free Year End Report Templates Smartsheet

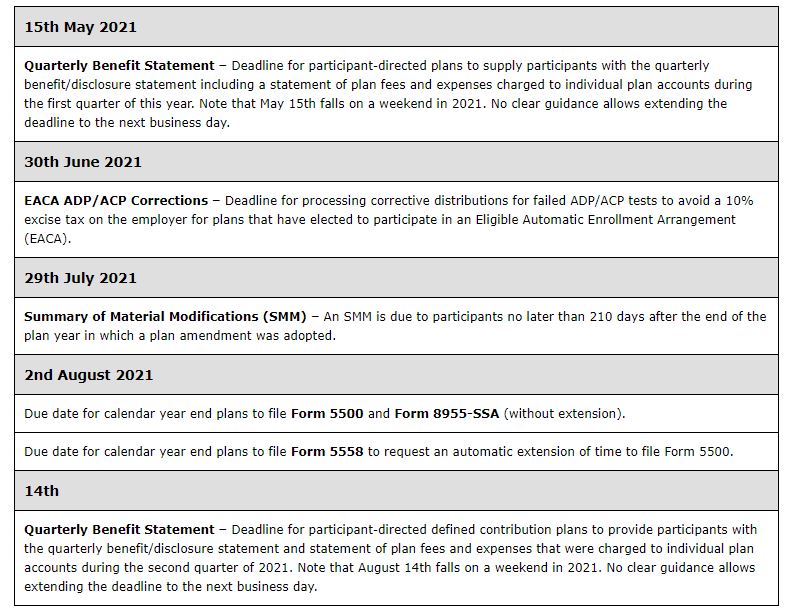

Spring 2021 Trpc Newsletter The Retirement Plan Company

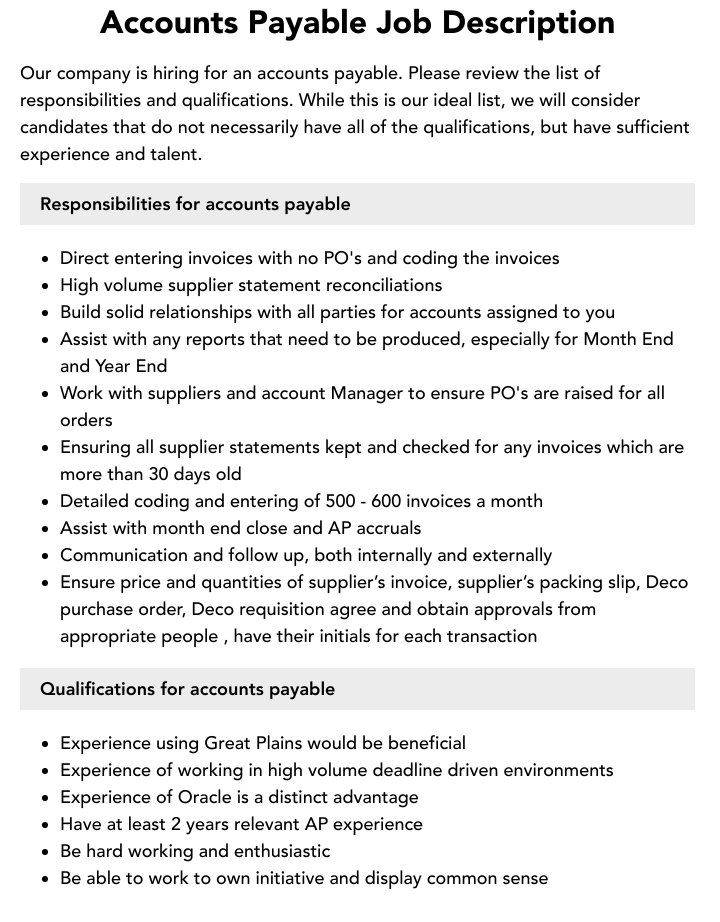

Accounts Payable Job Description Velvet Jobs

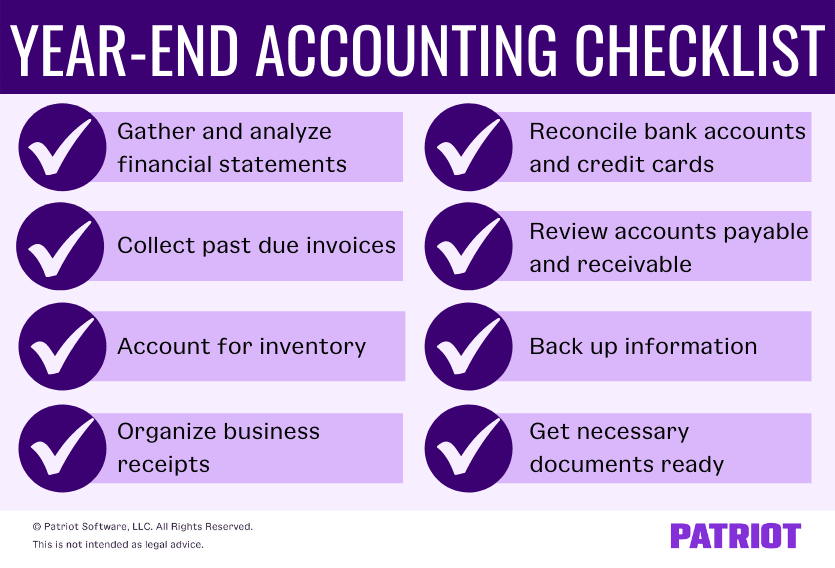

Year End Accounting Checklist 8 Tasks To Cross Off Your List

Are You Ending 2016 Healthy Wealthy And Wise Financial Planning Tucson Wellspring Financial Partners

Rg Tax And Accounting Services Facebook